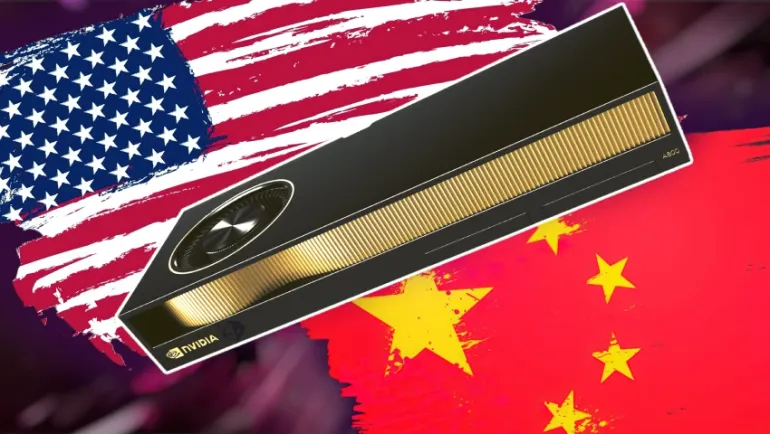

Nvidia is developing a new artificial intelligence (AI) chip specifically designed for the Chinese market. This move comes in response to U.S. export restrictions that have blocked the sale of its most powerful chips, like the A100, H100, and the recently banned H20, to China. With growing demand for AI processing power in the region and mounting competition from domestic chipmakers, Nvidia is aiming to retain its presence without violating export controls.

Over the past year, U.S. authorities have tightened restrictions on advanced chip exports to China. These rules are aimed at limiting China's access to cutting-edge AI and data center technologies. As a result, Nvidia’s most advanced graphics processing units (GPUs) were deemed too powerful to be exported. These limitations significantly impacted Nvidia’s revenue from China, which once made up a sizable portion of its global sales.

The restrictions not only caused Nvidia to halt shipments of some of its flagship AI chips to China but also resulted in billions of dollars in unsold inventory. To continue doing business in the region, Nvidia must create chips that fall below the performance thresholds outlined in U.S. export regulations—without compromising too much on AI capability.

In response, Nvidia is working on a new AI chip, rumored to be based on its latest Blackwell architecture. While the exact name and specifications have not been officially confirmed, reports suggest that this new chip will offer a downgraded version of the performance seen in Nvidia’s top-tier products, but still powerful enough to support AI training and inference tasks commonly used in Chinese data centers.

The chip is expected to use limited memory bandwidth and lower performance metrics to comply with export regulations. Despite the restrictions, Nvidia aims to deliver a product that is competitive and usable for machine learning, cloud computing, and large language models within Chinese enterprises and institutions.

Nvidia's position as a global leader in AI hardware is closely tied to its dominance in the data center GPU market. China has historically been a major buyer of Nvidia’s products, and losing that market to competitors—especially domestic firms like Huawei, Biren, and Moore Threads—could erode Nvidia's global influence.

By creating a new chip tailored to China's regulatory environment, Nvidia is not only attempting to recapture lost revenue but also maintain its ecosystem dominance. Nvidia’s CUDA platform, which is essential for developing AI applications, remains widely used in China. By offering a legal, capable alternative, Nvidia can keep Chinese developers within its ecosystem.

One of the major risks Nvidia faces is the rise of homegrown Chinese chipmakers. Companies like Huawei have already launched AI-focused processors designed to replace foreign GPUs. While these chips are not yet as powerful or versatile as Nvidia's flagship products, they are rapidly improving and gaining market traction due to geopolitical tailwinds and government support.

If Nvidia is unable to provide a viable alternative in time, Chinese companies may transition entirely to local solutions, cutting Nvidia out of the market permanently. The new chip project is therefore seen as a race against time—balancing compliance, innovation, and market share.

Industry insiders suggest that Nvidia’s China-specific chip may be ready for production by mid to late 2025. The company is expected to roll it out in limited volumes initially, scaling up as demand solidifies and regulatory clarity improves. By the end of the year, Nvidia hopes to regain a measurable portion of its previous sales volume in China, depending on how receptive local buyers are to the downgraded chip.

Many enterprise customers in China are currently sitting on the fence, waiting to see whether Nvidia can deliver a chip that is both legally compliant and practically useful. If Nvidia succeeds, it could slow down the momentum of domestic challengers and preserve its market relevance in a region vital to the future of AI development.

Nvidia’s strategy showcases how tech companies must constantly adapt to a rapidly shifting geopolitical landscape. The balance between innovation and regulation has never been more critical. For Nvidia, this new chip is not just a product—it’s a lifeline to a market that remains central to its growth plans.

Despite the performance compromises necessary for export approval, the chip is expected to retain key features of the Blackwell architecture, including improved efficiency, thermal management, and advanced parallel computing capabilities. Nvidia will likely market the product as a cost-effective solution for mid-tier AI workloads, enabling Chinese firms to continue developing next-generation AI services without violating international law.

Nvidia’s work on a new China-compliant chip reflects the company’s agility and determination to stay competitive amid intense regulatory pressure. While the final product may not match the raw performance of its flagship chips, it represents a critical bridge to maintain relationships and business continuity in one of the most important technology markets in the world.

The success or failure of this initiative could set a precedent for how global tech companies respond to geopolitical fractures. If executed well, Nvidia may not only reclaim some of its lost ground but also reinforce its brand as a global leader that adapts without compromising its core strengths.

Comments

There are no comments for this Article.